Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

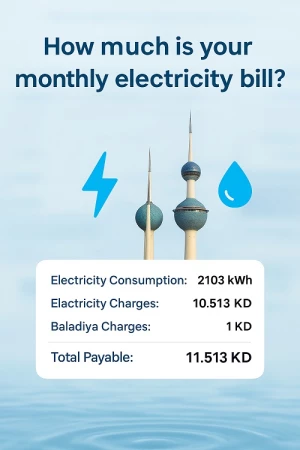

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

My Salary Is Kwd 750 What Would Be My Full And Final Settlement

I have a base salary of 750 KWD, worked for my company from October 2010 to April 2023, and my annual vacation ticket price is 255 KWD. How much will my full and final settlement be?

Understanding Your End of Service Indemnity and Final Settlement in Kuwait

When an employee resigns or leaves a company in Kuwait, they are typically entitled to an end-of-service benefit, known as an indemnity. Additionally, employees may receive a final settlement which includes any outstanding vacation balance and flight ticket allowance. Here, we will break down how you can calculate these amounts, using a specific example.

Step 1: Determine Your Basic Salary and Benefits

First, calculate your total monthly salary by adding your base salary and additional benefits.

Example:

Base Salary: 750 KWD

Vacation Ticket Price per Year: 255 KWD

Monthly Vacation Price: 255/12 = 21.25 KWD

Total Monthly Salary: 750 + 21.25 = 771.25 KWD

Step 2: Calculate End of Service Indemnity

Your indemnity is calculated differently depending on how long you have been employed:

First 5 Years of Service

For the first 5 years, the indemnity is calculated as half a month’s salary for each year of service.

Formula:

Total Monthly SalaryWorking Days per Month∗Indemnity Days∗Years of ServiceWorking Days per MonthTotal Monthly Salary∗Indemnity Days∗Years of Service

Example: 771.25/22 ∗15∗5 = 2629.26

The no of working days per months depends on your company , if you are working for 6 days a week , the no of working days per month would be 26 days , if you are working 5 days a week the nof ow roking days would 22 days per month

After 5 Years of Service

After the initial 5 years, the calculation uses your full monthly salary for each additional year of service.

Formula: Total Monthly Salary∗Years of Service after 5 yearsTotal Monthly Salary∗Years of Service after 5 years

Example: 771.25∗7=5398.75KWD

Remaining Months

If you have additional months beyond complete years, use this calculation:

Formula: Total Monthly SalaryWorking Days per Month∗Indemnity Days∗Remaining MonthsWorking Days per MonthTotal Monthly Salary∗Indemnity Days∗Remaining Months

Example: 771.2522∗15.3=537.72KWD22771.25∗15.3=537.72KWD

Total Indemnity

Sum the indemnities for the first 5 years, the years after 5, and the remaining months:

Example: 2629.26.68+5398.75+537.72 = 8565.73 KWD

Step 3: Calculate Outstanding Vacation Balance

Different companies handle leave balance payments in various ways. Here are three possible scenarios:

- Full Payment: The company pays the full salary for your pending leaves.

- Extra Payment: Some companies may pay a extra (e.g., 1.5 times the salary) for pending leaves.

- No Payment: In some cases, the company may not pay for pending leaves.

In this example, the payment for two months of leave is: 2∗750=1500KWD2∗750=1500KWD

Step 4: Calculate Outstanding Vacation Tickets

Calculate any pending vacation ticket allowance for the year.

Example: For 6 months worked in 2023: 2552=127.5KWD2255=127.5KWD

Step 5: Sum Your Final Settlement

To find your final settlement, sum your indemnity, outstanding vacation balance, and vacation ticket allowance.

Example: 8565.73+1500+127.5=10,193.23KWD

Conclusion:

Exiting a company comes with various financial components, and it’s crucial to understand what you are entitled to. This example shows a final settlement of 10,193.65 KWD when leaving the company.

Please note that regulations and company policies can vary, and the exact formula may differ in your situation. It is advisable to consult with your HR department and the local labor law to confirm your entitlements.