Latest News

- Kuwait-Jordan Durra Field Joint Statement Rejected By Iran

- GTD Cracks Down On Vehicle Noise Pollution In Sulaibiya

- Mystery Of Dead Fish At Shuwaikh Beach Sparks Urgent Action

- MEW To Complete Links With The Interior And Justice Ministries B...

- 8 Expats Jailed For Bribing An Officer To Obtain Driver's Licens...

- Weekend Weather Is Expected To Be Hot

- From Tomorrow, Traffic Diversion On Third Ring Road

- Ministry Of Health Refute Rumors On Non-availability Of Antibiot...

- Amir Of Kuwait And Jordan King Renew Commitment To Regional Secu...

- 37 Arrested With Narcotics And Firearms

- Outrage Over Candidate's Arrest

- Six Stores Shut Down In Jahra For Selling Fake Goods

Check Your Credit Score,max Personal Loan Eligibility,existing Loans, Emis And Credit Cards

Manage Your Credit Profile with Cinet, Kuwait's Comprehensive Financial Platform

In the digital age, maintaining your financial health is as important as looking after your physical wellbeing. Cinet, a breakthrough financial management platform based in Kuwait, is committed to aiding individuals and corporate entities in gaining complete control over their financial profiles. It's now easier than ever to check your credit score, loan eligibility, existing loans, and much more with Cinet.

Self Inquiry: Your Credit Health Checkup

Cinet allows customers to perform a self inquiry, which is essentially a credit report that reveals one's credit status. This report delineates the history of your transactions and credit obligations, offering a digital credit rating index for individuals. By regularly reviewing their credit report, customers can confirm the accuracy of their personal credit information, dispute any discrepancies, protect against identity fraud, and perform a primary self-assessment prior to applying for credit.

Getting Started with Cinet

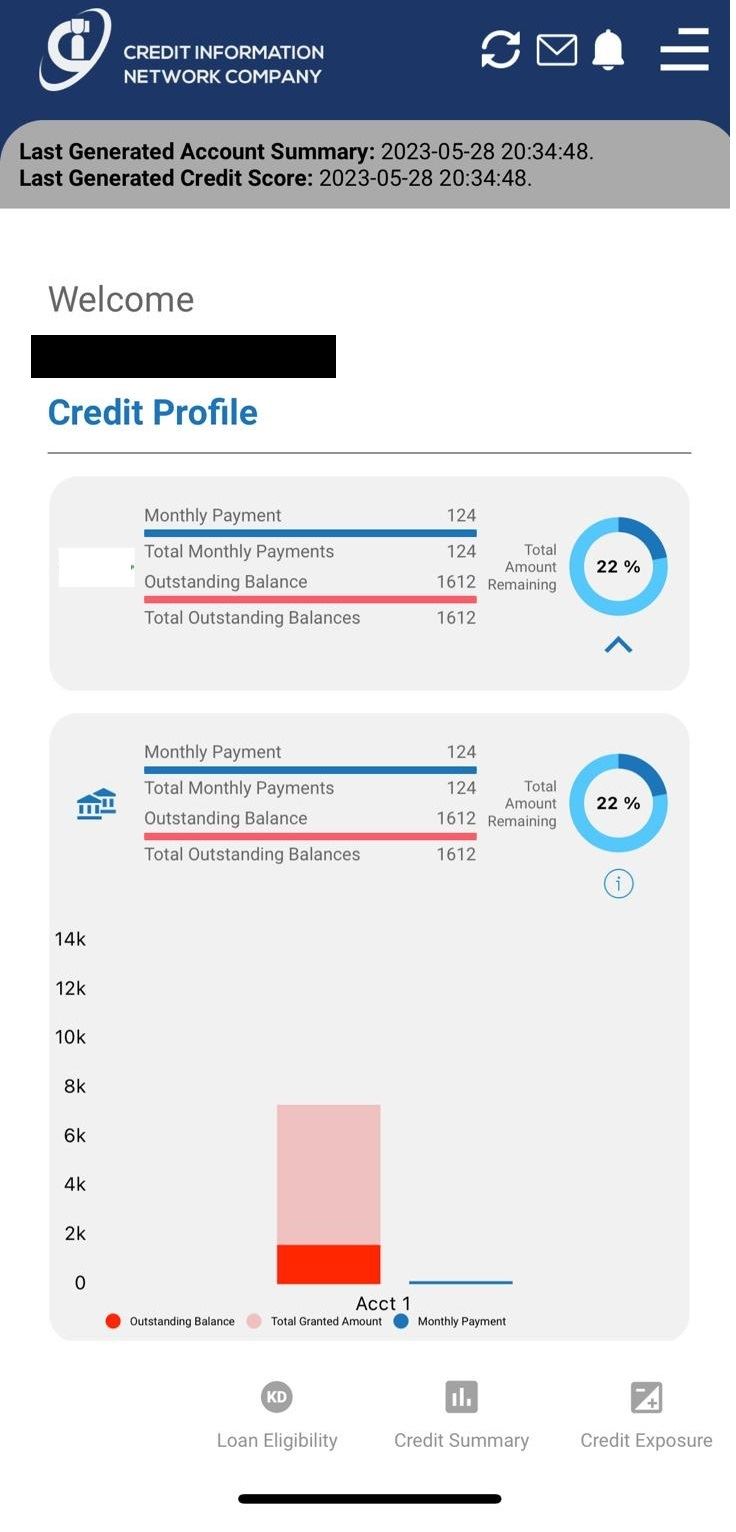

To start your financial health journey with Cinet, simply register using your mobile ID, providing all the necessary details such as mobile number and email. Once logged in, users can navigate to the "Credit Profile" tab visible at the bottom left of the app's interface.

Unpacking Your Credit Profile

Under "Credit Profile", you can view your existing loans, loan providers, the monthly EMI being paid, and the total remaining amount of the loan.

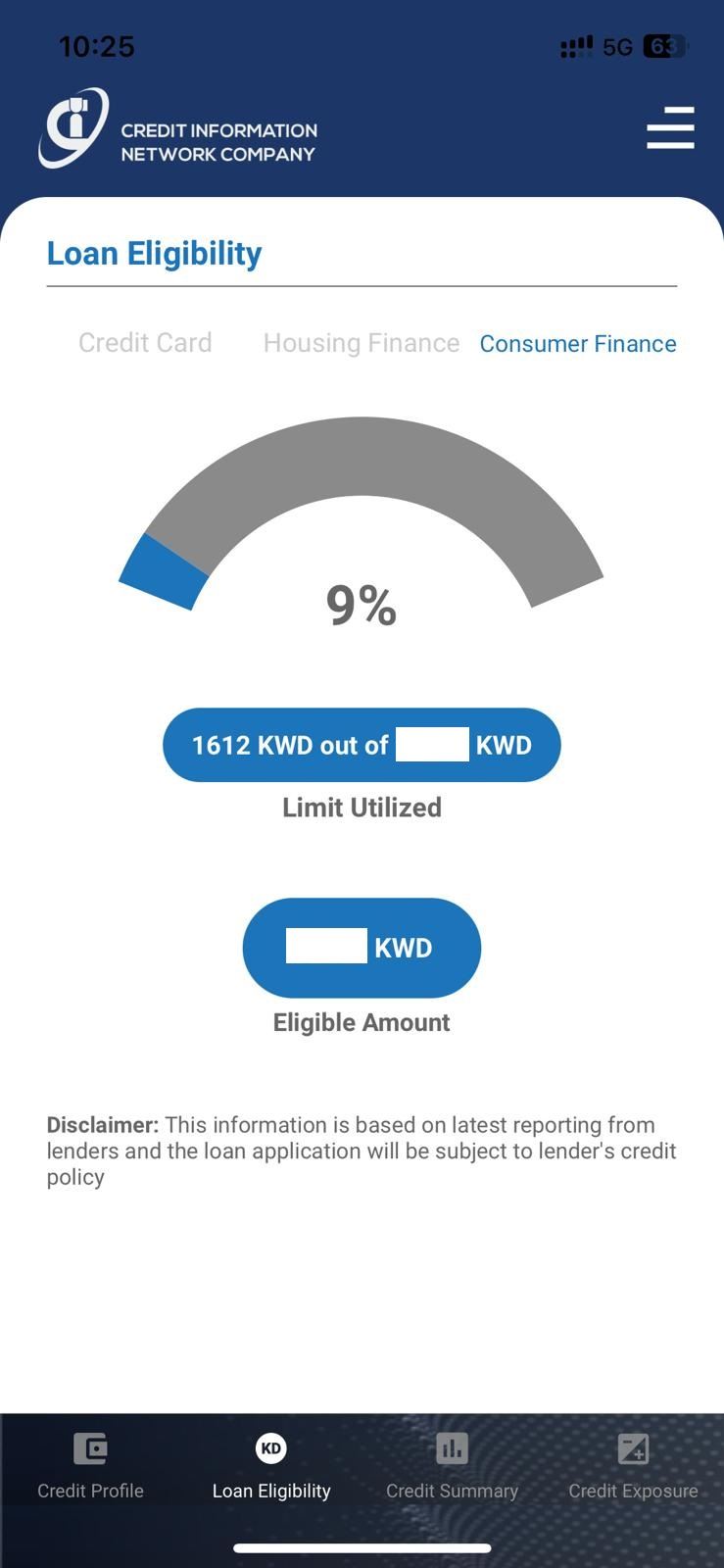

Understanding Loan Eligibility

Moving on to the second tab, "Loan Eligibility", you get to see your potential for different types of loans: credit card, housing finance (exclusive for Kuwaitis), and consumer finance. It not only shows the maximum amount you're eligible for but also the amount utilized if you have existing loans.

Exploring Credit Summary

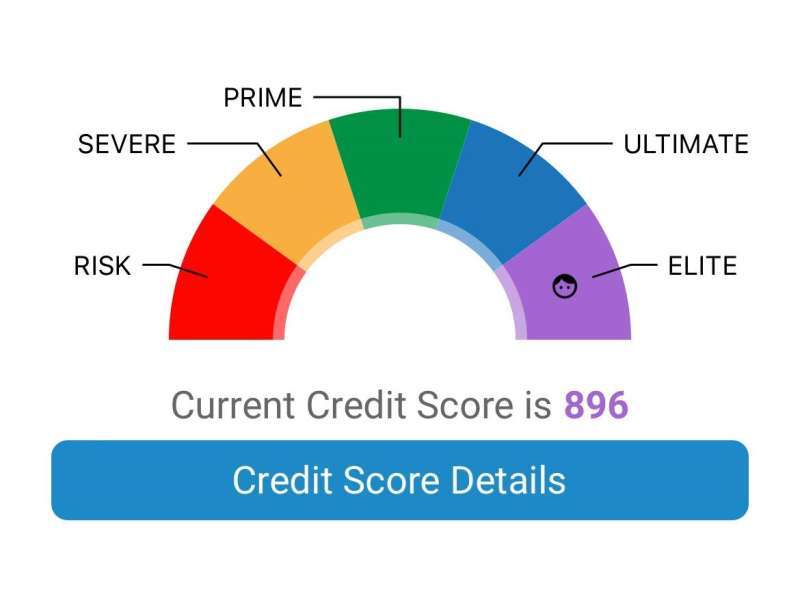

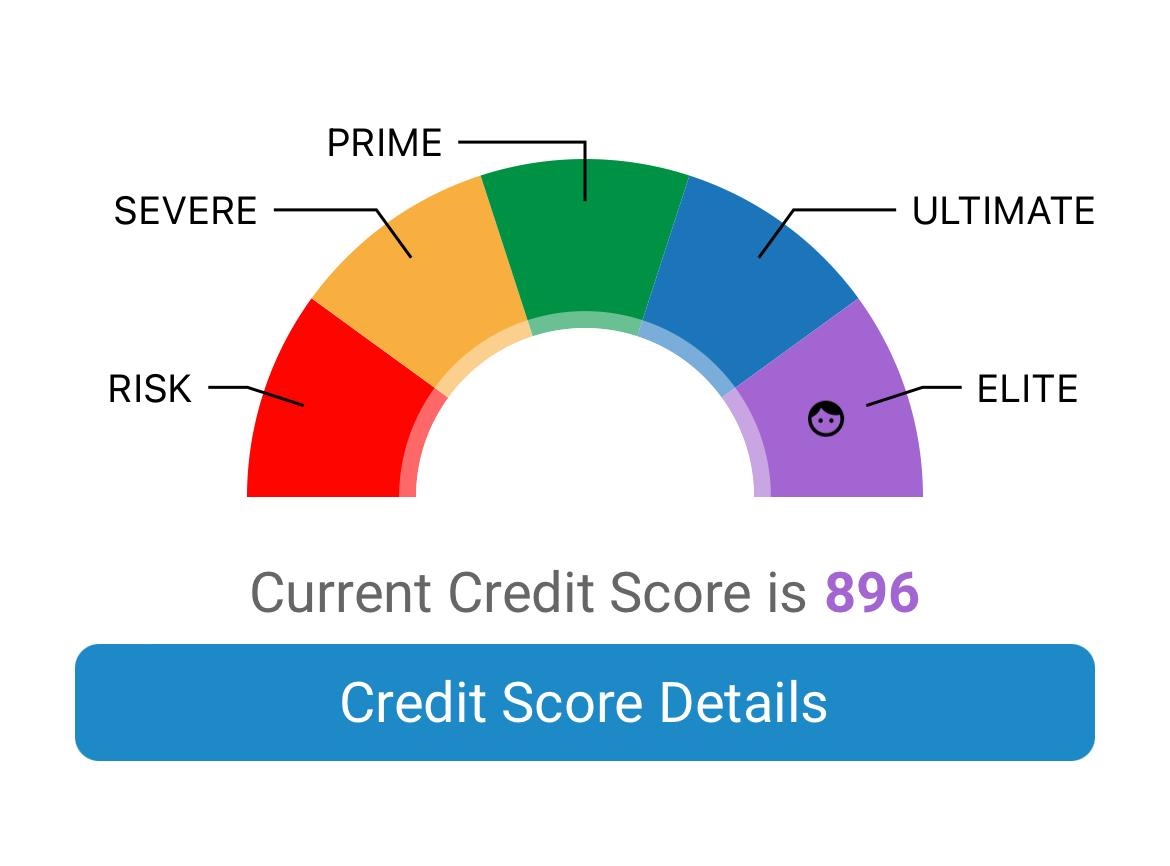

The third tab, "Credit Summary", displays your overall credit score. Cinet classifies credit scores under five categories - Elite, Ultimate, Prime, Severe, and Risk. An "Elite" rating signifies an excellent score, enhancing your chances of loan approval, while a "Risk" rating suggests potential difficulty in obtaining loans.

Navigating Through Credit Exposure

Lastly, the "Credit Exposure" tab gives you an overview of your total loans, payments made, and outstanding balances.

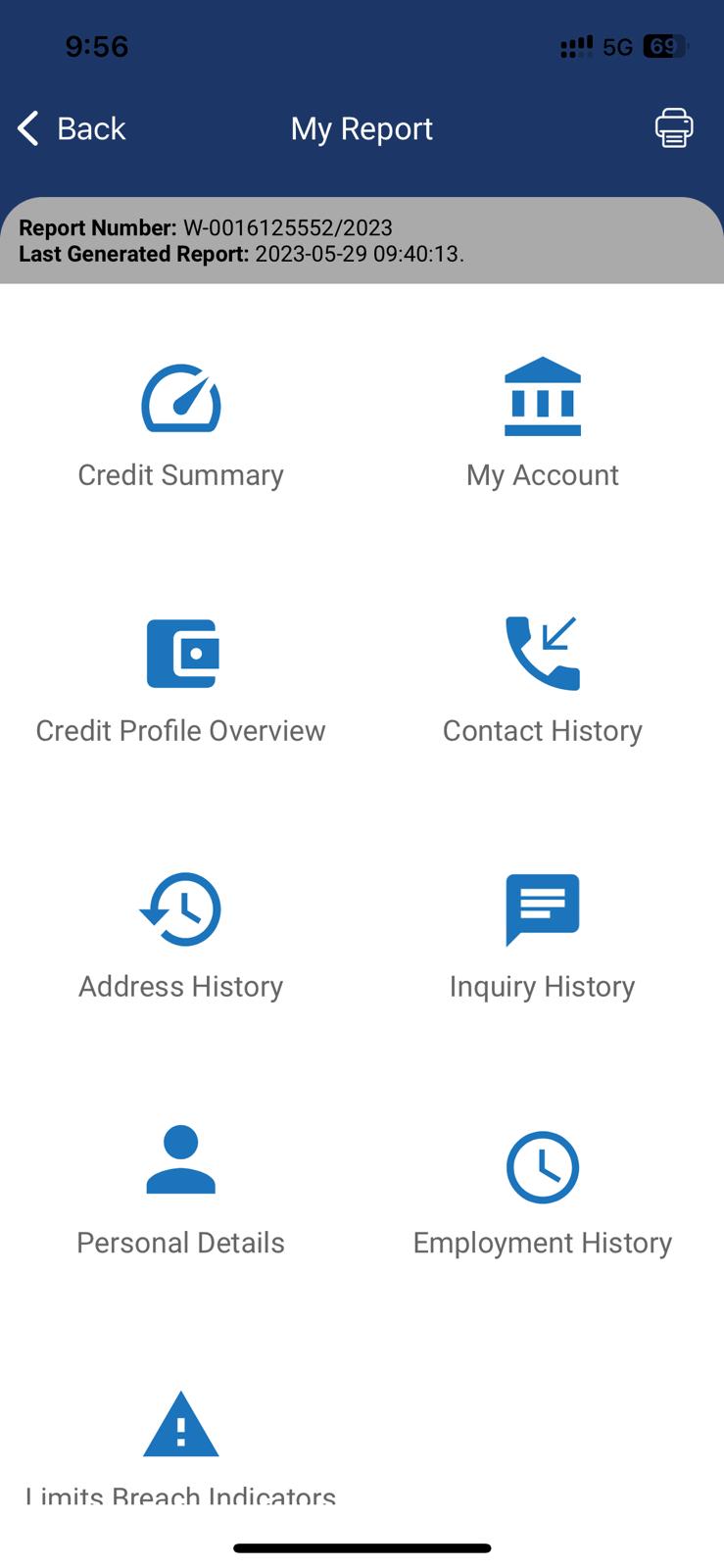

My Report

For more detailed insights, you can generate a comprehensive report by clicking on "My Report" in the menu, featuring a credit summary and account details for all open and closed loans and credit card accounts.

Accessing Cinet: At Your Service, Anytime, Anywhere

Cinet’s comprehensive financial management services are accessible through their Android and iOS apps, as well as their website. For queries and assistance, you can reach out to them at their hotline number 1800808.

Android App: Cinet Android App

iOS App: Cinet iOS App

Website: Cinet Official Website

Cinet makes credit management in Kuwait straightforward and accessible, setting the benchmark for financial health platforms across the region. Take charge of your financial health today with Cinet.

Trending News

-

Kuwait Implements Home Biometrics Services Ahead O...

14 April 2024

Kuwait Implements Home Biometrics Services Ahead O...

14 April 2024 -

Kuwait Airways Provides Update On Flight Schedule...

14 April 2024

Kuwait Airways Provides Update On Flight Schedule...

14 April 2024 -

Kuwait Airways Introduces Convenient Home Luggage...

15 April 2024

Kuwait Airways Introduces Convenient Home Luggage...

15 April 2024 -

Expat Residency Law Amended By Kuwait Ministerial...

20 April 2024

Expat Residency Law Amended By Kuwait Ministerial...

20 April 2024 -

Two Expats Are Arrested For Stealing From Salmiya...

17 April 2024

Two Expats Are Arrested For Stealing From Salmiya...

17 April 2024 -

An Egyptian Expat Dies At Kuwait's Airport

11 April 2024

An Egyptian Expat Dies At Kuwait's Airport

11 April 2024 -

Kuwait Airways Resumes Flights To Beirut And Oman...

15 April 2024

Kuwait Airways Resumes Flights To Beirut And Oman...

15 April 2024 -

Bay Zero Water Park Kuwait: Summer Season Opens Ei...

11 April 2024

Bay Zero Water Park Kuwait: Summer Season Opens Ei...

11 April 2024 -

Temperature Increases Cause Electricity Load Index...

21 April 2024

Temperature Increases Cause Electricity Load Index...

21 April 2024 -

Thief Returns Stolen Money With An Apology Letter...

15 April 2024

Thief Returns Stolen Money With An Apology Letter...

15 April 2024

Comments Post Comment