Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

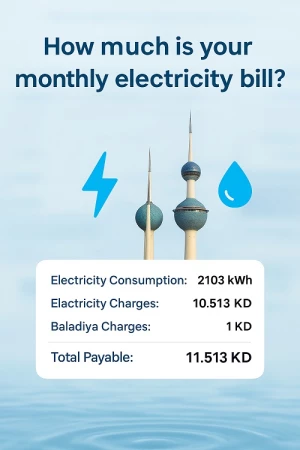

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

India To Collect 20% Tax On Remittances. Should Nris Be Worried?

Introduction

The term "tax" often elicits a sense of apprehension, primarily because it's synonymous with an inevitable decrease in our financial reserves. In this guide, we delve into India's Tax Collected at Source (TCS), specifically focusing on its application to overseas remittances. This regulation became effective on July 1, 2023.

The Liberalised Remittance Scheme (LRS) and Its Purpose

Indian residents frequently travel internationally for various reasons, including education, medical treatments, business dealings, tourism, and visiting friends or relatives. In response to this, the Reserve Bank of India introduced the Liberalised Remittance Scheme (LRS) on February 4, 2004. This scheme enabled individuals (excluding companies) to transfer up to $25,000 in foreign currency per financial year (from April to March) for specific purposes. Notably, the permissible transfer limit was subsequently increased to $50,000 in 2007 and $250,000 in 2013.

TCS Implementation to Combat Tax Evasion

Over time, Indian tax authorities identified discrepancies in many cases between the taxable income declared by individuals and the amount transferred overseas annually. To address potential tax evasion, the Indian government implemented the TCS on LRS remittances from October 1, 2020.

Under this policy, an Indian tax resident can transfer up to $250,000 (approximately Dh918,000) without seeking special approval from the Reserve Bank of India. However, these transactions will now be subject to TCS. The foreign exchange dealer collects a 5% TCS and transfers it to the tax department under the taxpayer's Permanent Account Number (PAN). The taxpayer can subsequently claim credit for this TCS when filing their annual income return.

A Significant Increase in TCS in 2023

India's finance minister announced a substantial change in the 2023 budget, increasing the TCS rate from 5% to 20%, effective July 1, 2023. As a result, funds transferred overseas for vacations, investments, or other purposes (excluding education and medical expenses) will now incur a 20% TCS.

Educational remittances exceeding Rs700,000 (around Dh31,500) will continue to be subject to a 5% TCS, while all other expenses will be charged at the higher 20% rate. However, for overseas educational expenses funded by loans, the TCS rate is reduced to 0.5% of the remittance proceeds (up to the loan amount), with no change in the 2023 budget.

Impact on Indian Investors

The increase in TCS from 5% to 20% significantly impacts individuals making remittances, as they must now pay the TCS at the point of transfer and offset it against their tax liability for that financial year. This change may also deter Indian residents from investing in international stock markets, real estate, or businesses. Despite their growing popularity among India's affluent population, potential investors may reconsider their decisions unless they are prepared to pay the higher TCS rate upfront under the LRS and claim it back when filing their tax return.

A Sigh of Relief for Non-Resident Indians (NRIs)

However, the new regulations offer some relief for Non-Resident Indians (NRIs), as the TCS increase only applies to resident Indians transferring funds abroad through the LRS. NRIs transferring funds from their Non-Residential Ordinary (NRO) account to their Non-Residential External (NRE) or foreign accounts are not subject to TCS. Additionally, if an NRI visiting India opts for

an overseas tour package, they will not be subjected to TCS, as clarified by the Central Board of Direct Taxes in a press release on March 31, 2022.

TCS vs TDS: The Role of Advance Tax

Like Tax Deducted at Source (TDS), TCS operates as an upfront tax paid by resident Indians, considered a prepayment and offset against their tax liability for the financial year. While the increase in TCS results in higher cash outflows for taxpayers, it simultaneously leads to a rise in the government's tax revenue.

Conclusion: Navigating India's TCS on Overseas Remittances

Understanding India's Tax Collected at Source (TCS) and its implications for overseas remittances is crucial for both resident and non-resident Indians. The increase from 5% to 20% has significant implications for residents, especially those intending to invest abroad. For more insights into the world of international remittances and Indian taxation, check out our other resources [link to related articles on your website].

By implementing these SEO strategies, this article now features relevant keywords, clear headings and subheadings, and an internal link to other related articles on your website. This will improve the article's search engine visibility and make it more accessible to readers.