Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

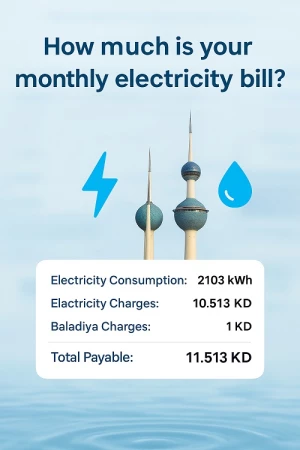

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Kuwait Sells Egyptian Pounds For 10 Percent Less Than Their Value

A few days ago, Bloomberg Agency said that the largest banks in the world had come to the conclusion that Cairo needed to weaken its currency once more due to the mounting pressure on the Egyptian economy.

The agency cited analyses from Deutsche Bank, Goldman Sachs, and Citigroup that found the Egyptian currency to be overvalued despite a devaluation of more than 15% in March. Deutsche Bank and Goldman Sachs found the pound to be overvalued by 10%, while Citigroup found the pound to be undervalued by 5%, according to a local Arabic daily. The sources emphasized that Cairo's quest of a fresh loan from the International Monetary Fund has made additional currency flexibility necessary.

According to experts, as long as convertible foreign currencies are available, the black market for the currencies of nations like Egypt that have a fixed or partially floating exchange rate with the dollar typically survives.They claimed that despite open discussion about Egypt's need to pay roughly $30 billion within months and the lack of convincing evidence indicating the prospect of payback thus far, the reduction in cash flows from foreign currency is currently driving the depreciation of the pound.

The price of the pound on the black market recently increased by another double, but it still costs about 1.5 Kuwaiti dinars less than it does at the cheapest exchange companies, which at the same time transferred money at a rate of 16.2 dinars per thousand pounds, representing a 10% price reduction.

When they finally transferred their regular monthly payments to their families and related instalments that were owed to them, a group of traditional remittance dealers, whose opinions were solicited by the daily in this regard, reported that what they called remittance dealers offered them to implement them at very different prices, whether when compared to official prices or when measured at a cost. their previous transfer.

According to them, they finally received a better deal than what was being provided to them in the official market, receiving between 1.4 and 1.5 dinars for every thousand pounds as opposed to the quarter and a half dinars they had been getting for weeks. In addition to paying between half a dinar and a dinar for each transfer ranging from one thousand to five thousand pounds under the name of the home delivery bill, they noted that they were paying remittance traders the same official exchange rate months earlier, indicating that something had changed recently by lowering the value of the exchange rate on the black market by about half a dinar in comparison to the official market, to finally arrive at the final exchange rate of one dinar.

Specifically since the Egyptian central bank floated the currency, they reported that the black market for the Egyptian pound in Kuwait is humming with activity after being restricted for many years. They also noted that it was observed in the recent period that the activity of remittances to Egypt by individual traders in the market has increased. The exchange companies started giving reduced pricing after learning about the underground market or so-called under-economy of the pound, which cost them some of their market share.

It was noted that the exchange market experienced a state of stability despite the slight increase in the value of the dollar relative to the Egyptian pound. The acting governor of the Central Bank of Egypt, Hassan Abdullah, continued his meetings, which included a number of ministers and prominent officials in the Egyptian government, in addition to officials of local banks.