Latest News

- Kuwait-Jordan Durra Field Joint Statement Rejected By Iran

- GTD Cracks Down On Vehicle Noise Pollution In Sulaibiya

- Mystery Of Dead Fish At Shuwaikh Beach Sparks Urgent Action

- MEW To Complete Links With The Interior And Justice Ministries B...

- 8 Expats Jailed For Bribing An Officer To Obtain Driver's Licens...

- Weekend Weather Is Expected To Be Hot

- From Tomorrow, Traffic Diversion On Third Ring Road

- Ministry Of Health Refute Rumors On Non-availability Of Antibiot...

- Amir Of Kuwait And Jordan King Renew Commitment To Regional Secu...

- 37 Arrested With Narcotics And Firearms

- Outrage Over Candidate's Arrest

- Six Stores Shut Down In Jahra For Selling Fake Goods

Kuwait Stocks Extend Losses, End Week In Red Turf

Boursa Kuwait ended last week in the red zone. The Premier Market Index closed at 5,172.99 points, down by 1.60%, the Main Market Index declined by 0.44% after closing at 4,697.73 points, and the All-Share Index closed at 5,004.00 points down by 1.22%. Furthermore, last week’s average daily turnover increased by 51.27%, compared to the preceding week, reaching around K.D 18.15 million, whereas trading volume average reached around 69.95 million shares, recording an increase of 4.82%.

The three market indices recorded different losses for the third consecutive week in light of the continued strong selling pressures that included many stocks of different sectors, especially the leading and heavy stocks, which was refl ected on the Premier Market Index’s performance in particular, the most declining Index during the last week.

Also, the Market losses last week came amid a noticeable growth in the trading activity compared to the previous week’s trading, especially the total cash liquidity that increased by more than 51.27%, reaching K.D. 90.75 million, while the total number of traded stocks during the last week increased by 4.82%, reaching 349.73 million stock.

In addition, Boursa Kuwait indices recorded remarkable losses in the first session of last week, as it lost more than KD 410 million of its market cap by the end of the same session, which came due to the steep declines recorded by most of the international and GCC stock markets, and resulted in pushing many traders to execute random selling operations on most of the listed stocks in the Market, which were negatively reflected on the three Boursa indices, especially the All-Share Index and the Premier Market Index, that recorded its highest loss in one day, since the application of the new market segmentation. Moreover, the Market’s loss in a week reached around KD 347.21 million, as the market cap of the total listed stocks decreased by the end of the week to reach about KD 28 billion against KD 28.35 billion in a week earlier, with a loss of 1.22%.

The Boursa gains, since the application of the new market segmentation, contracted to reach approximately K.D. 143.29 million only, or by 0.51%. (Note: The market cap for the listed companies in the Boursa is calculated based on the weighted average number of outstanding stocks as per the latest available official financial statements).

Furthermore, such negative performance of the Market during the last week came despite the positive disclosures of some local banks on its 9 months periodic results for the current year, meanwhile many traders are still watching for the disclosures of the remaining banks and listed companies to define their investment goals for the next period, especially that such results will determine to a great extent the financial performance of the listed companies during the year 2018. Last week witnessed trading over 146 stock out of 175 listed stock in the Market, where prices of 51 stock increased against prices of 79 stock decreased, and prices of 45 stock remained at no change.

Sectors’ Indices

Ten of Boursa Kuwait’s sectors ended last week in the red zone, only one recorded increase, while the Health Care sector remained at no change. Last week’s highest loser was the Telecommunications sector, as its index declined by 3.90% to end the week’s activity at 869.41 points. The Consumer Goods sector was second on the losers’ list, which index declined by 2.19%, closing at 797.72 points, followed by the Technology sector, which index declined by 1.71%, closing at 836.63 points. On the other hand, last week’s only gainer was the Basic Materials sector, achieving 0.33% growth rate as its index closed at 1,229.92 points.

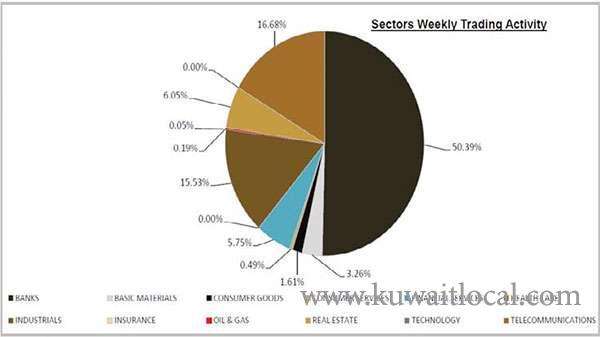

Sectors’ Activity

The Banks sector dominated a total trade volume of around 116.73 million shares changing hands during last week, representing 33.38% of the total market trading volume. The Real Estate sector was second in terms of trading volume as the sector’s traded shares were 23.24% of last week’s total trading volume, with a total of around 81.28 million shares. On the other hand, the Banks sector’s stocks were the highest traded in terms of value; with a turnover of around K.D 45.73 million or 50.39% of last week’s total market trading value. The Telecommunications sector took the second place as the sector’s last week turnover was approx. K.D 15.14 million representing 16.68% of the total market trading value. For more information, please visit our website: www.bayaninvest.com

SOURCE : ARABTIMES

Trending News

-

Kuwait Implements Home Biometrics Services Ahead O...

14 April 2024

Kuwait Implements Home Biometrics Services Ahead O...

14 April 2024 -

Kuwait Airways Provides Update On Flight Schedule...

14 April 2024

Kuwait Airways Provides Update On Flight Schedule...

14 April 2024 -

Kuwait Airways Introduces Convenient Home Luggage...

15 April 2024

Kuwait Airways Introduces Convenient Home Luggage...

15 April 2024 -

Expat Residency Law Amended By Kuwait Ministerial...

20 April 2024

Expat Residency Law Amended By Kuwait Ministerial...

20 April 2024 -

Two Expats Are Arrested For Stealing From Salmiya...

17 April 2024

Two Expats Are Arrested For Stealing From Salmiya...

17 April 2024 -

An Egyptian Expat Dies At Kuwait's Airport

11 April 2024

An Egyptian Expat Dies At Kuwait's Airport

11 April 2024 -

Kuwait Airways Resumes Flights To Beirut And Oman...

15 April 2024

Kuwait Airways Resumes Flights To Beirut And Oman...

15 April 2024 -

Bay Zero Water Park Kuwait: Summer Season Opens Ei...

11 April 2024

Bay Zero Water Park Kuwait: Summer Season Opens Ei...

11 April 2024 -

Temperature Increases Cause Electricity Load Index...

21 April 2024

Temperature Increases Cause Electricity Load Index...

21 April 2024 -

Thief Returns Stolen Money With An Apology Letter...

15 April 2024

Thief Returns Stolen Money With An Apology Letter...

15 April 2024

Comments Post Comment