Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

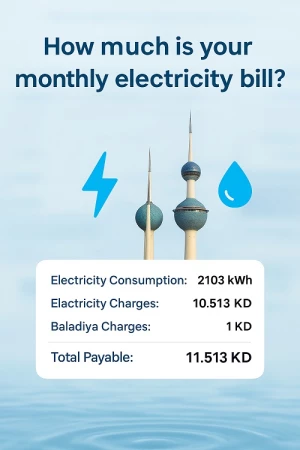

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Insurance Key In Over-60s Rethink

Expatriate holders of high school certification and are above the age of 60 years are waiting for the Public Authority for Manpower (PAM) to complete the preparation of a set of regulations related to the decision to bar the issuance of work permits for the aforementioned category of expatriates, reports Al-Rai daily quoting informed sources. They said, “Private health insurance is one of the basic solutions to this matter. Many of the expatriates over the age of 60 have lived in the country for decades. They have accumulated experiences over the years that are more important than university degrees.

The regulations that PAM is preparing are aimed at setting balance between the labor market’s need for expertise and modifying the demographics. The imposition of private health insurance is one of the most important solutions to renew work permits for this group based on the understanding that this will prevent any added pressure on the public health sector. Among the ideas circulating is that the annual value of the insurance policy should be KD 500. However, concerned parties in the insurance sector informed the daily that determining the price must be associated with the services covered by the policy, and the aforementioned amount is unrealistic based on the current market data.

The daily approached specialists in the insurance market with this matter, and discovered that the value of health insurance for one year for those who have reached the age of 60 and want to renew their residency may exceed KD 1,000, since the documents issued for this age class classify clients as “high risk”, and they usually have a history of chronic diseases. The concerned parties highlighted that the evaluation process is subject to many conditions, such as the rate of insurance coverage, the services it provides, the client’s participation in paying part of the expenses, and limiting treatment to the private sector or with the state’s participation in providing medical services. In this regard, Tariq Al-Sahaf, the CEO of Gulf Insurance Group, explained that the process of determining the price of the health insurance policy for residents who have reached 60 years of age and wish to renew their residency in accordance with the proposed amendments is subject to technical determinants and actuarial calculations, which determine the fair value of the policy as per the risk levels and technical conditions. Setting the price at KD 500 for the health insurance policy of those aged 60 and above is outside the concept of insurance, as determining the price must be associated with the services covered by the policy. The aforementioned amount is unrealistic according to the current market data.

Case

He highlighted a currently applied model that can be used as a guide in this case, which is the “Afia” insurance. Here, the price of the policy exceeds KD 1,000, which means the estimated price of the policy at KD 500 cannot cover all the needs of the age group. Meanwhile, the Executive Vice President of Zamzam Takaful Insurance Company Mahjoob Al-Mahjoub said, “After revealing the features of the residency renewal procedures for those who have reached the age of 60, some companies have started their actuarial studies in determining the appropriate price for the health insurance policy.” Al-Mahjoub explained that, “According to the study of experiences of previously issued insurance policies for this age group, and taking into account the insurance, technical and legal reserves that are in line with the new Insurance Regulatory Unit Law No. 125/2019 and its executive regulations, the lowest price of an individual premium for one year can be estimated at KD 950, with a requirement to bear the policy of not less than 25 percent, and to pay the full value of the premium upon issuance, for cases with no satisfactory history, which may be few.”

He added, “If you take into account the presence of individuals who want to renew their residency, and have a history of illness, companies may need to increase the insurance premium, so that they do not have to refuse insurance coverage for these cases, as well as set up a mechanism for them to receive medical treatment.” Al-Mahjoub said, “The most important determinant is the treatment mechanism, and whether their treatment will be limited only to the private sector, or if the Ministry of Health will be involved in the process. This is a major determinant in the matter. If treatment is limited to the private sector, KD 1000 will not suffice as the price for the policy. However, with the participation of the Ministry of Health, and ensuring whether the client would pay part of the bill, the policy may remain within the limits of KD 1,000.”

In the same context, a source familiar with the conditions of the insurance market in Kuwait said, “An estimated amount of KD 500 for health insurance as one of the conditions for residency renewal cannot in any way cover the needs of health care services required for people of that age category. Even a KD 1,000-worth policy is not enough. Such a policy cannot be priced at this level, even if the services of some hospitals and agencies in the Ministry of Health are sought.” The source explained that the price of the insurance policy increases directly with higher risks. In the case of health insurance, younger people have lower levels of risk. They have insurance policies, the prices of which commensurate with the lower health risks they are likely to be exposed to. Regarding those aged 60 and over, health risks rise, as people become vulnerable to many diseases. This requires health care services that may be continuous and of high cost, during which the cost of insurance becomes useless.

SOURCE ARABTIMES