Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

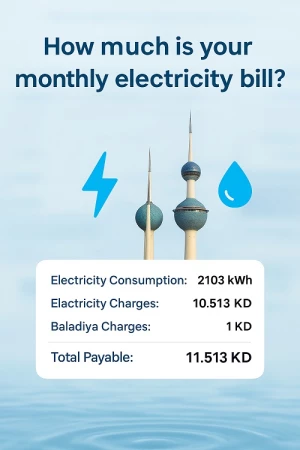

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

59 Pc Tax Rate Imposed On Foreign Oil Companies

The tax rate imposed on foreign oil companies that operate in the divided zone between Kuwait and Saudi Arabia and are subjected to the laws of Kuwait is 59 percent quoting informed sources.

They said the tax rate is based on several factors topped by the companies’ income and the concluded contracts. The sources revealed that Kuwait has started preparations for resuming production gradually in the joint oil fields with Saudi Arabia.

They explained that the tax laws and systems in Kuwait are divided based on several categories. First is the Zakat tax, which obliges Kuwaiti joint-stock and closed companies to pay Zakat tax of one percent of the annual net profits to Ministry of Finance. Second is the national labor subsidy tax, which obliges the Kuwaiti joint-stock companies to pay tax of 2.5 percent of the annual net profits.

SOURCE : ARABTIMES