Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

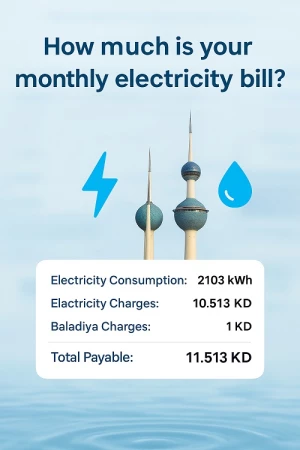

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

What Happens To Your Bank Account In Kuwait When Your Residency Expires?

In Kuwait, expatriates’ access to their bank accounts is closely tied to the validity of their residency. Once a resident's legal status lapses—either through expiry or cancellation—most financial institutions initiate an account freeze, limiting or halting access to essential services such as ATM withdrawals, credit card transactions, and online banking.

Why Banks Freeze Accounts After Residency Expires

Banks in Kuwait require valid Civil ID records as proof of legal residency. Once the residency permit expires, the Civil ID is no longer valid, leading banks to consider the account holder as not legally present in the country. As a result, the bank enforces a freeze on the account to remain compliant with financial regulations.

This policy also applies to Bedoun residents, who similarly face restricted access to their funds if their residency documents expire, regardless of the reason or duration since expiration.

What Happens When Your Residency Expires?

- ATM Withdrawals Blocked: Most banks suspend access to ATMs.

- Online and Mobile Banking Inaccessible: Logins are blocked until residency details are updated.

- Credit Card Usage Suspended: Transactions may be declined.

- Salary Deposits Held: Employers’ transfers may not reflect in frozen accounts.

Some banks may provide limited access for up to three months or impose reduced withdrawal limits, but these measures vary by institution and are not guaranteed.

How to Restore Full Banking Access

To regain full control over their bank accounts, expatriates must:

- Renew their residency through the Ministry of Interior.

- Update their Civil ID at the PACI (Public Authority for Civil Information).

- Inform their bank with the new Civil ID details to lift the freeze.

Staying Compliant: What Expats Should Do

To avoid financial service disruptions, expatriates are urged to:

- Monitor residency expiry dates proactively.

- Start renewal procedures early to account for any administrative delays.

- Notify their bank promptly after updating Civil ID records.

Kuwait has been consistently updating its digital infrastructure and residency-related protocols. Services like the Sahel App can help residents track and manage Civil ID statuses efficiently.

Conclusion

Banking access in Kuwait is strictly dependent on a valid residency status. Whether you're an expatriate or a Bedoun resident, it's crucial to keep your documents up to date. Regularly renewing your residency and promptly updating banking information ensures uninterrupted access to your funds and essential financial services.