Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

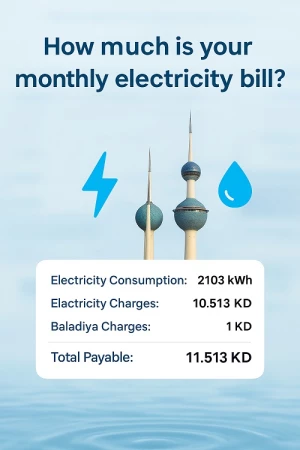

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Vat May Be Replaced By Excise Tax In Kuwait

Kuwait Times reported that Kuwait may choose to apply excise tax as its first choice for tax collection instead of value added tax (VAT).

In Kuwait, VAT is widely rejected both at the popular and parliamentary levels, and the government has excluded it from its plans for the next three years.

The move is to apply excise tax on tobacco and its derivatives, soft and sweetened drinks and luxury goods such as watches, jewelry and precious stones, as well as luxury cars and yachts, the Daily reported. The tax may be in the range of 10 to 25 percent.

Kuwait wants to implement VAT in accordance with its agreement with Gulf Cooperation Council countries, but it is currently difficult to have it approved by the national assembly due to popular and parliamentary opposition.

The proposed excise tax is expected to bring around KD 500 million annually, noting it does not affect incomes of low- and middle-income people, as it targets luxury goods that are not considered to be basics for living.

Get The Latest and important news on our Telegram Channel click here to join