Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

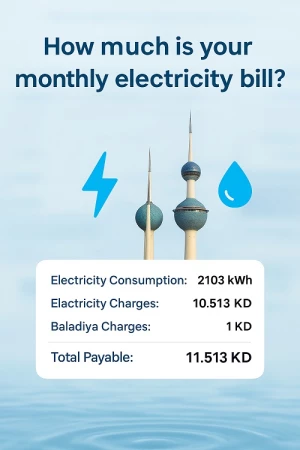

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Oil Revenues In Kuwait Surpass 25 Billion Dinars For The First Time

As oil prices remain stable at acceptable levels, financial sources anticipate that oil revenues in the current fiscal 2022-2023 will exceed 25 billion dinars for the first time in years, after revenues of around 20 billion dinars during the past three quarters.

According to the same sources, oil prices have increased significantly over the breakeven price in the general budget estimated at $80 per barrel since the beginning of the current fiscal year in April 2022, reaching about $113 per barrel in the first quarter, while declining during the second quarter.

After reaching approximately $103 per barrel in the first nine months of the current fiscal year, it dropped to $88 per barrel in the third quarter, bringing the average selling price for Kuwaiti oil barrels to $101.8.

The sources expect that oil prices will continue their upward trajectory during the last quarter of the current fiscal year, which ends on March 31; bringing the total oil revenues to about 25 billion dinars, which is the highest in 8 years, and therefore the budget will return to recording a surplus of two billion thus ending the series of financial deficits, which since the beginning of 2015 totaled about 39 billion dinars, which were covered by the General Reserve Fund, which at that time was forced to give up assets in order to provide “cash” to finance the general budget deficit.

The government will release a draft budget for the new fiscal year 2023-2024 during the coming period, which is expected to increase the percentage of current expenditures, with a number of expenditure items announced by the government to improve the lives of citizens in the budget.

Furthermore, the government continues to plan to maximize the contribution of non-oil revenues to the budget by examining financial and economic reforms, whether that be through pricing public services and raising some fees, or by developing a method for collecting state revenues and selling non-government real estate assets. exploited, and reassessment for the usufruct of state lands and real estate.

According to the report of the Organization of Arab Petroleum Exporting Countries (OAPEC), oil prices are supported by five factors:

- The International Energy Agency expects global demand for oil to rise to a record level in 2023, and OPEC maintains its positive expectations regarding demand.

- The prosperity of the prospects for the Chinese economy in light of the easing of restrictions related to the Corona virus, which reinforced expectations about a recovery in demand in the largest global importer of oil.

- Concerns about Russian oil production being negatively affected by the European embargo to be imposed on imports of Russian petroleum products transported by sea on the fifth of next February.

- The number of oil rigs operating in the United States of America decreased to the lowest level since last November, in an early indication of future production.

- The decline in the US dollar index, amid hopes that the Federal Reserve will move towards increasing interest rates at a lower rate, which made oil less expensive in other currencies.

Get The Latest and important news on our Telegram Channel click here to join