Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

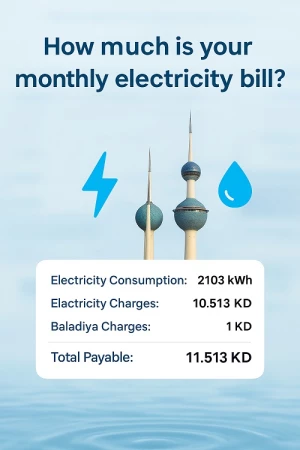

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Kuwait’s Banks Plan To Impose Fee On Online Transfers As Usage Soars

Kuwaiti banks are evaluating a proposal to introduce charges for online transfers between different banks, replacing the current free-of-charge system. According to sources cited by Al-Rai, banks aim to generate revenue to support digital transformation initiatives while maintaining the existing KD 5 fee for branch-based transactions.

Fee Structure and Transfer Methods

The proposed charges would apply only to interbank online transfers, ranging between KD 1 and KD 2, with individual banks setting their own rates. However, intra-bank transfers within the same financial institution will remain free for customers.

Some banking professionals have suggested extending these fees to transfers made via payment links or the “Wamd” service, given their role in handling high-volume commercial transactions. Currently, these services allow daily transfers of up to KD 3,000, making them significant players in Kuwait’s digital banking landscape.

Rationale Behind the Proposal

Banks argue that the surge in online transactions, especially for commercial payments, has led to increased operational costs. The rapid expansion of electronic banking services necessitates ongoing investment in infrastructure, security measures, and process enhancements to ensure seamless transactions.

Despite the general agreement among banks on implementing these fees, a proposal to exempt “links” and “Wamd” transfers failed to gain enough support. Some industry experts worry that charging fees on fast money transfers could disproportionately impact small-scale transactions between individuals.

Regulatory Considerations and Financial Inclusion

The Central Bank of Kuwait remains cautious about any fee increases on electronic payments, aligning with its commitment to financial inclusion and digital banking accessibility. The regulator is yet to approve the proposal, as it seeks to balance banking sector sustainability with consumer-friendly digital services.

Future of Digital Banking in Kuwait

As banks continue investing in digitization, they emphasize the necessity of introducing sustainable revenue models. However, regulatory approval will play a critical role in determining whether online transfer fees become a standard practice in Kuwait’s banking sector.

Would you support a small fee on online transfers to enhance banking services? Let us know your thoughts.