Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

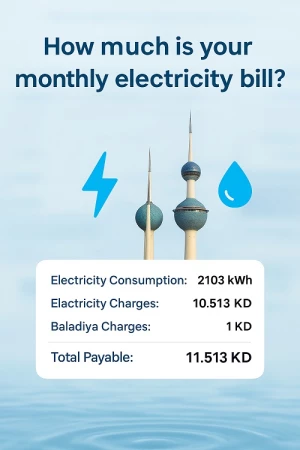

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Kuwait Local Banks Refuse To Provide Financial Information About Their Clients Without Permission

Local banks have affirmed their refusal to provide financial information about their clients without the permission of the latter, reports Arab Times daily quoting informed sources. They explained that some countries have been considering implementing a law to demand income tax from their citizens who work in Kuwait and other Gulf and Arab countries.

However, such a law will necessitate automated exchange of financial information of the expatriates working in different parts of the world especially in the countries that are part of the relevant agreement. These expatriates may have to declare their salaries based on which income tax will be collected.

For salaries between KD 100 and KD 499, the tax collected will possibly be four percent of the salary. Due to this, banks are hesitant to provide any information about their clients without the permission of the latter.

Meanwhile, the sources revealed that many Kuwaiti holders of American citizenship have started giving up their American citizenships due to the Foreign Account Tax Compliance Act (FATCA) Law.

SOURCE : ARABTIMES