Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

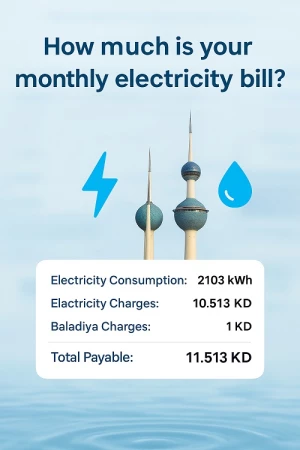

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Kuwait Launches Third National Debt Relief Campaign For Citizens

In alignment with Kuwait's leadership directives to strengthen social solidarity and alleviate financial hardship, the Ministry of Social Affairs has launched its third national campaign to settle the debts of citizens in need. The campaign is set to begin on Friday, March 14, and will continue for a month, collaborating with charitable organizations under the ministry’s direct supervision to ensure fairness, integrity, and transparency.

Ensuring Fair and Transparent Debt Settlement

The ministry emphasized that this initiative reflects the government's commitment to supporting financially distressed citizens. A structured mechanism has been established to ensure that aid reaches eligible individuals. This includes clear guidelines and standards developed in partnership with approved charitable organizations to guarantee equitable distribution and prevent any irregularities.

To enhance transparency, an electronic monitoring system will be utilized to track both the collection and disbursement of donations, ensuring compliance with the established regulations.

Eligibility and Application Process

- Applicants must be Kuwaiti citizens with non-criminal financial obligations.

- They must provide official documentation proving financial hardship.

- Debts must not be linked to illegal activities or informal financing entities.

The maximum aid limit per individual has been set at 20,000 Kuwaiti dinars, ensuring that a greater number of citizens benefit from the initiative.

Debt Settlement Mechanism

To ensure legal compliance, the disbursement of funds will follow structured procedures:

- For individuals facing travel bans, vehicle seizures, or salary garnishments, payments will be processed through the Civil Enforcement Department at the Ministry of Justice.

- For indebted citizens serving sentences in correctional institutions, the General Department for the Implementation of Criminal Judgments at the Ministry of Interior will oversee the settlement process.

Centralized Digital Registration

Applications for financial aid will be handled exclusively through the Central Aid Platform, a unified electronic system designed to promote efficiency and fairness. The ministry has confirmed that no in-person applications will be accepted, ensuring compliance with digital governance standards.

Exclusions and Restrictions

- Illegal financial transactions and debts linked to telecommunication companies or unregulated lenders will not be covered.

- Citizens who have previously benefited from similar debt relief programs are excluded.

This approach ensures fair distribution of resources and prevents duplication of aid.

Commitment to Sustainable Charitable Work

The Kuwaiti government remains committed to localizing charitable work and strengthening social welfare initiatives. By integrating digital solutions, the ministry aims to:

- Enhance transparency in aid distribution.

- Maximize the impact of available resources.

- Align charitable initiatives with national development plans to support vulnerable communities.

The launch of this third national campaign underscores Kuwait’s ongoing efforts to promote sustainable giving and reinforce the nation’s social solidarity framework.