Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

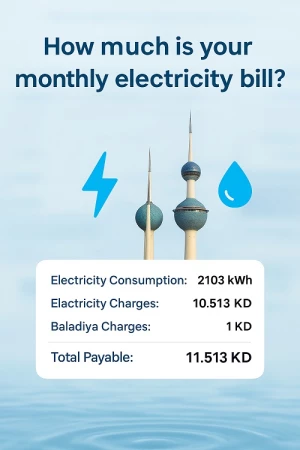

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Kuwait Exempts 175 Activities From Store Licensing Requirements: Boosting Microbusinesses With New Regulations

"Ministry of Commerce and Industry Facilitates Self-Employment with Four-Year Licenses and Reduced Capital Requirements"

Introduction

In a move to promote self-employment and microbusinesses, the Ministry of Commerce and Industry in Kuwait has exempted 175 activities from the requirements for licensing commercial stores. This exemption is designed to encourage entrepreneurial ventures by simplifying the licensing process and providing more opportunities for small-scale businesses to thrive.

Key Details of the New Regulations

Under Ministerial Resolution No. 168/2024, individuals engaging in these exempted activities can now obtain a self-employment license, which will be valid for four years. To qualify, applicants must be at least 21 years old, unless they have been authorized to practice trade by the court. This initiative opens doors for young entrepreneurs and those interested in starting microbusinesses without the burden of traditional store licensing requirements.

Licensing Requirements and Conditions

Despite the exemptions, license holders must adhere to specific guidelines to maintain their eligibility. Key requirements include:

Address Specification: The license holder must provide an address, post office box, or email registered with the Public Authority for Civil Information (PACI), as per the latest update. If the address is a private residence, approval from the property owner is required.

Payment of Fees: Proof of payment for the prescribed fees must be submitted along with the license application.

Activity Addition: License holders are allowed to add more than one activity, provided the additional activity is freelance-related and complementary or similar to the existing licensed activity.

Disclosure Requirements: The license number must be disclosed on all electronic and social media platforms used for conducting the licensed activity.

Electronic Transactions: All commercial transactions must be conducted through electronic payment methods only.

Reduced Capital Requirements and Activity Expansion

To further support microbusinesses, the ministry has reduced the capital required to practice licensed freelance activities under this decision to half of what is typically required for similar activities in registered companies. This reduction significantly lowers the entry barriers for aspiring entrepreneurs.

Impact on Kuwait's Business Landscape

This initiative by the Ministry of Commerce and Industry is expected to significantly impact Kuwait's business landscape by making it easier for individuals to start and operate small businesses. The four-year validity of the license, combined with reduced capital requirements, provides a substantial incentive for self-employed individuals and microbusinesses to flourish.

Conclusion

The exemption of 175 activities from store licensing requirements marks a pivotal step in fostering an entrepreneurial spirit within Kuwait. By simplifying the licensing process and reducing financial barriers, the Ministry of Commerce and Industry is paving the way for a new wave of microbusinesses that can contribute to the nation's economic growth and diversification.