Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

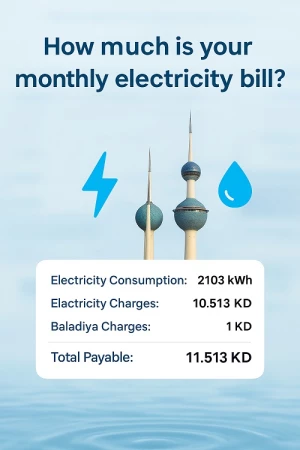

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Kuwait Approves Thirty Five Projects Worth $51 Billion

Kuwaiti Government Approves $51 Billion in Infrastructure Projects; Insights from KAMCO Invest on Gulf Region's Project Activities

The Kuwaiti government has greenlit 35 major projects worth approximately $51 billion, aimed at modernizing the nation's infrastructure and facilities, according to a report by KAMCO Invest, as cited by Al Rai newspaper. The projects signify a significant investment push to upgrade essential sectors, with plans to complete a substantial portion of these initiatives by 2030.

Decline in Gulf Project Activities in Q3 2024

KAMCO Invest highlighted a notable decrease in the total value of project activities across the Gulf Cooperation Council (GCC) countries in Q3 2024. Project awards across the region fell by 15.3% to $54.2 billion, compared to $64.0 billion during the same period in 2023. Despite this downturn, three of the six Gulf countries saw growth in their project values, while the other three experienced declines.

Saudi Arabia Leads Gulf Project Market

As of October 2024, Saudi Arabia remained the leading market in the GCC, with $1.53 trillion worth of projects under planning or implementation, making up 55.9% of the total regional projects. The United Arab Emirates (UAE) followed with $627.6 billion, while Oman came third with $208.9 billion. Excluding projects already under implementation, Saudi Arabia accounted for 53% of planned future projects, equivalent to $763 billion, followed by the UAE at 20% ($287.1 billion). Kuwait's future project value stands at $108.4 billion, representing 7.5% of the GCC's total.

Sector Highlights: Construction and Transport Dominate

The construction sector dominated the Gulf project landscape, accounting for 30.9% ($444.6 billion) of the total planned projects, followed by the transport sector, which comprised 19.7% ($283.5 billion). These sectors remain critical to the ongoing development efforts across the region.

Saudi Arabia's Project Market Sees Robust Growth

Saudi Arabia recorded a 22.7% year-on-year increase in project awards during Q3 2024, reaching $35.4 billion, up from $28.8 billion in Q3 2023. This growth is attributed to the Kingdom's economic diversification initiatives under Vision 2030, which focus on infrastructure modernization and development across key sectors, including energy and transportation.

Noteworthy Projects in Saudi Arabia

Among the significant contracts awarded in Q3 2024 was a $3.7 billion project for constructing HVDC transmission stations in Riyadh, led by a partnership between Al-Fanar Company and China Electrical Equipment and Technology Corporation. Additionally, Aramco awarded a $2.5 billion contract to Saipem for infrastructure work at the Murjan oil and gas field.

UAE: Second-Largest Gulf Project Market

The UAE maintained its position as the second-largest project market in the Gulf, securing 18.8% of the region's total project awards, although this was a decrease from 40.4% in Q3 2023. Key projects included an engineering, procurement, and construction contract for a tank warehouse at Abu Dhabi Airport, awarded by ADNOC.

Kuwait's Project Market Expected to Rebound

Kuwait's project market saw a total of $2.1 billion in contracts awarded in Q3 2024, marking a 10.9% year-on-year decrease from $2.3 billion in Q3 2023. Despite this dip, the Kuwaiti government is positioning the market for a comeback with plans to invest $51 billion in 35 approved projects, focusing on infrastructure enhancements, road construction, and rail networks.

Key Projects in Kuwait

Significant initiatives include a $3.3 billion housing development for 9,800 residences, a $1.4 billion road enhancement program, and a $3.2 billion development of the Mubarak Al-Kabeer Port. Another key project involves the construction of a 111-kilometer railway, which will connect Kuwait with the broader Gulf railway network.

Qatar's Project Sector Recovers Strongly

Qatar experienced a 57.9% increase in project awards in Q3 2024, reaching $4.2 billion, a recovery from the previous quarter’s low of $187 million. The gas sector led this growth, accounting for 94.6% of the total contracts awarded, with significant projects including a $4 billion contract for gas infrastructure developments.

Conclusion

The Gulf region continues to be a dynamic market for large-scale projects, with a focus on economic diversification, infrastructure modernization, and regional integration. Despite fluctuations, countries like Saudi Arabia, Kuwait, and Qatar are making strides in driving growth through strategic investments, while the UAE remains a critical player.