Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

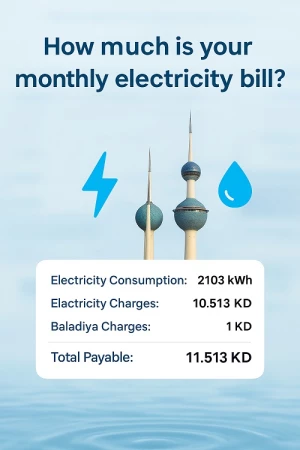

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Kuwait Alters Debt Seizure Rules

In line with Decree-Law Nos. 58 and 59/2025, amending Bankruptcy Law No. 71/2020 and Civil and Commercial Procedures Law No. 38/1980, the enforcement departments have started lifting the seizure of all debtors' assets held by banks. This comes pending the adoption of a new mechanism for handling debt cases.

Adjustments to Salary Seizures for Debt Recovery

The new amendments stipulate that only half of debtors' salaries will be seized, as instructed by Head of the Enforcement General Administration Counselor Abdullah Al-Othman. The implementation of this procedure started a week ago with instructions sent to the governor of the Central Bank of Kuwait.

Travel Bans and Vehicle Seizures Remain in Effect

Ongoing Procedures for Debt Cases

Although the lifting of asset seizures has begun, travel bans and vehicle seizures remain in place. These measures are expected to continue until the finalization of the new procedures outlined in the amended laws.

Implementing the New Enforcement Mechanism

Changes to Computer Systems and Asset Seizure Process

The Enforcement General Administration has started amending its computer system to implement the new law, ensuring that assets held by third parties will be seized, focusing on the salary deductions of debtors (those subject to execution). The seizure will range from 25% to 50% of the salary, as determined by law based on the nature of the debt and the debtor’s workplace.