Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

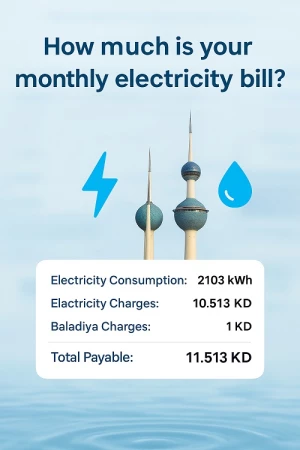

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Expat Unpaid Loans And Debt Settlement In Kuwait

Debit and Loan Settlement in Kuwait: A Comprehensive Guide for Expats

Kuwait, known for its oil-rich economy and modern infrastructure, is a popular destination for expatriates looking for lucrative employment opportunities. Expats account for nearly 70% of the country's population, contributing significantly to its economy. However, navigating the financial landscape, especially in terms of loans and debt settlements, can be challenging for these individuals. This article provides an in-depth exploration of debit and loan settlement in Kuwait, offering valuable guidance to expats on managing their financial obligations effectively.

Essential Steps for Resolving Unpaid Debt in Kuwait

-

Understand Your Debt: The first step is to gather all relevant details about the debt. This includes the owed amount, the creditor's information, and the terms and conditions of the loan agreement. It is crucial to understand the nature of the debt, including any penalties or interest rates applicable.

-

Assess Your Financial Situation: An honest evaluation of your financial standing is necessary. This includes considering your income, expenses, and other outstanding debts. This assessment will help you determine your repayment capacity and formulate a feasible plan.

-

Communicate with Your Creditor: Open communication is crucial when dealing with unpaid debts. Reach out to the bank or the credit institution and express your intention to settle the debts. You may discuss your financial situation and negotiate repayment terms.

-

Negotiate a Settlement: If you're unable to repay the full amount, consider negotiating a settlement. This typically involves reaching an agreement to pay a reduced amount, which the creditor considers as full debt settlement. You may seek the help of a legal advisor or a reputable debt settlement company.

-

Develop a Repayment Plan: If the creditor agrees to a payment plan, formulate a realistic budget that enables you to make consistent payments towards the debt. Prioritize debt repayment within your overall financial commitments.

-

Obtain a Clearance Letter: After fulfilling the agreed-upon payment terms, request a Clearance Letter from your bank. This letter serves as proof that you have met your financial obligations.

-

Seek Financial Counseling: Consulting a financial advisor can provide valuable insights into debt management, budgeting, and saving. They can guide you on formulating a debt repayment strategy and managing your finances effectively.

-

Know Your Legal Rights: Understanding the legal framework in Kuwait will help you navigate the process and ensure your rights are upheld.

Key Factors Considered by Kuwait Banks for Settling Unpaid Debt

Kuwaiti banks consider various factors while settling unpaid debts. These factors include:

-

Payment Capacity: The ability of the borrower to repay the loan, considering their current financial status and any changes in personal circumstances since the loan was granted.

-

Income and Co-borrowers/Guarantors: The borrower's current income, potential co-borrowers or guarantors, and their income level are taken into account.

-

Payment History: The borrower's payment history is reviewed by banks to assess their reliability in meeting financial commitments.

-

Assets and Residence: The borrower's assets and current residence are considered during negotiations.

-

Family Needs and Maintenance: The borrower's family situation and their financial requirements are also considered.

What if an Expat Left The Country Without Paying Loans

If an expatriate in Kuwait goes back to their home country without settling their loans, Kuwaiti banks can still attempt to recover the debt, similar to the process described for the UAE. Here's an overview of how the process generally works:

-

Local and International Debt Collection: If an expatriate leaves Kuwait without repaying their loan, the bank can approach a debt collection agency. These agencies operate both locally and internationally and can pursue the debtor in their home country. While the laws and regulations of each country may impact the collection process, the agency can usually contact the debtor and attempt to recover the debt through negotiation or legal action.

-

Legal Action: If negotiation fails or the debtor is unresponsive, the bank can consider taking legal action. In some cases, they can file a case in Kuwait and transfer it to the debtor's home country via international courts, although this is a complex and expensive process. The specific procedures and possibilities for this vary depending on the bilateral agreements and legal frameworks between Kuwait and the debtor's home country.

-

Interpol Involvement: In extreme cases, Interpol may be involved if the debt is substantial and considered a case of fraud. However, this is relatively rare and typically only occurs with very large debts.

-

Damage to Credit Score: Regardless of the steps taken to recover the debt, the unpaid loan can damage the debtor's credit score. This can make it difficult for them to obtain loans or credit in the future, both in Kuwait and potentially in their home country and other locations.

-

Employment and Visa Implications: In some cases, if a debtor attempts to return to Kuwait or apply for a visa in another GCC country, they may face difficulties due to their unpaid debt.

It's important to note that while banks have these options for debt recovery, the specific steps taken can vary greatly depending on the circumstances. Also, different countries have different rules regarding international debt recovery, so the effectiveness of these methods can vary depending on the debtor's home country.

The best course of action is always to repay any debts or loans responsibly. If a debtor is struggling to repay a loan, they should contact their bank to discuss the situation and explore possible solutions, such as restructuring the loan or adjusting the payment terms.