Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

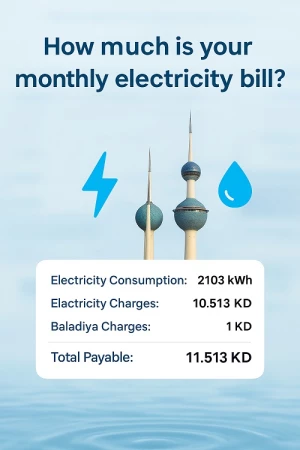

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Expat Loans - 20 Times Of Your Salary

With a strategic shift by banks towards financing expatriates and Bedoun residents, banks have decided to relax their strict policy towards financing expatriates and Bedoun residents, and allow the return of financing for non-Kuwaiti employees working in the private sector, allowing installment-based financing up to KD 70,000, as well as payment terms up to eight years without a guarantor, in line with banking practice that has become common in recent years, as long as the employer entity is trustworthy. According to bank sources, "Banks no longer turn down large segments of expatriates and Bedoun residents who work in the private sector."

Following the beginning of the COVID-19 pandemic, they decided to expand to them with unusual facilities and conditions since various private sector job segments will likely benefit, even those with low wages.

In order to make consumer loans more accessible to non-Kuwaitis, banks lending to them have, once again, cut the conditional salary limit from KD 500 as a minimum to KD 300. Additionally, the required work period has been reduced from a one-year minimum to four months, as long as the value of the consumer loan is determined based on salary and the deduction percentage follows Central Bank of Kuwait guidelines.

Among the recently implemented banking controls for lending to employees outside of the government sector, the sources said, "One of the most notable aspects of these controls is that customers must meet the loan eligibility conditions prescribed by the supervisory regulator."

The customer must have a credit history that is free of defaults. In addition, he must work for a company listed on the Kuwait Stock Exchange or listed on the bank's client list, or a company with adequate financial stability.

The customer should have a valid security card with sufficient validity if he is a Bedoun resident in addition to the above requirements." According to the sources, the loan limit for expatriates and Bedoun residents working in the private sector has been increased to 20 times their salaries for those earning high salaries.