Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

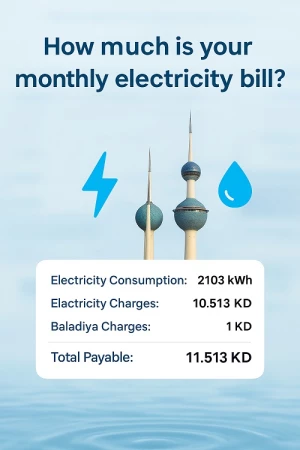

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Engineers Gets 800pct Return On Aston Martin Ipo, Becomes Billionaire

Kuwaiti engineer Najeeb Al Humaidhi holds a stake valued at 940.2 million pounds ($1.22 billion) in Aston Martin following the luxury automaker’s initial public offering Wednesday, according to the Bloomberg Billionaires Index. He sold stock worth 331.6 million pounds. Shares of the company fell 4.7 percent in London after pricing at the lower end of the expected range

Al Humaidhi, a civil engineer by training, is widely known in Kuwaiti business circles as a member of one of the country’s oldest merchant families whose wealth traces back to the country’s role as a prosperous trading hub in the 1700s. Today, its interests span construction materials, health care, banking and real estate.

The family is part of a group selling the Grosvenor House Suites on London’s Park Lane for $520 million, people with knowledge of the matter said.

The IPO gives Al Humaidhi and fellow Kuwaiti investors a return of more than 800 percent after they acquired a 79 percent stake from Ford Motor Co. in 2007. Al Humaidhi owns his shares through two wholly owned U.K.-based entities and through Adeem Automotive, a subsidiary of a Kuwaiti family investment house, which he shares with brother Waleed and Maryam Al Khaled, an investor.

A graduate of Alexandria University in Egypt, Al Humaidhi owns an eponymous architecture and design firm that has studios in Kuwait City, Cairo, Turkey and Australia. His 30–year-old son, Saoud, serves with him on Aston Martin’s board.

Al Humaidhi is still a billionaire even after accounting for a 375 million pound margin loan he obtained from banks working on the IPO, according to a person familiar with the transaction who asked not to be identified because the matter is private.

Aston Martin shareholders sold 25 percent of the business and exercised an over-allotment that may further reduce the collective stakes of Al Humaidhi, 66, and his fellow Kuwaiti investors by as much as 2 percent within the next 30 days.

The automaker’s prospectus singled out the Middle East and China as sources of burgeoning demand for the iconic British sports car because of rising personal wealth. Fourteen of the company’s 160 dealerships are located in the Middle East and North Africa region, with five more planned to open over the next four years. The Asia-Pacific region in particular is boosting sales and margins: the average price of cars sold there is 40 percent higher than those sold in the U.K., according to a filing.

SOURCE : BLOOMBERGQUINT