Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

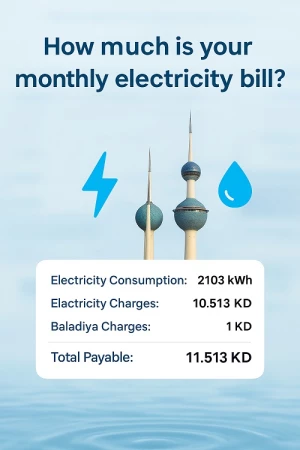

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Eiu Predicts Kuwait's Economy Will Grow At Its Slowest Rate In The Gulf By 2023 And 2024

In a recent analysis by Economist Intelligence Unit, it was concluded that the Middle East and North Africa region (MENA) performed well in 2022 when it came to attracting foreign direct investment (FDI), and that capital flows are expected to resume in 2023 and 2024.

Most of the region's economies will benefit from FDI flows due to the macroeconomic backdrop, and the unit predicts that more than half of them will achieve average economic growth rates of more than 3 percent over the next three years, reports Al-Rai daily.

Kuwait is expected to record the lowest economic growth in the Gulf during this year and the following years, as figures issued by "Economist Intelligence" indicate that Kuwait's real GDP will grow by 1.9 percent on average during this period. According to the UAE, Qatar will have the highest rate by 4 percent during the same period, followed by Bahrain at 3.5 percent, followed by Oman at 3 percent, and Saudi Arabia at 2.4%.

In addition, most countries in the region, particularly the Gulf states, will enjoy low inflation rates and stable exchange rates, which will encourage investment. Nevertheless, Egypt and Turkey, which are expected to face severe currency weakness and price pressures in 2023, are excluded from this unit, as are crisis countries such as Lebanon, Iran, Sudan, Syria and Yemen.

Kuwait would record the second highest inflation rate in the Gulf, after the UAE, over the average period of 2023, according to the unit. According to the report, the oil and gas industries in the region received a major injection of investment in 2022, and the outlook for foreign direct investment in the oil and gas industry appears promising in the future.

According to the unit, while global oil prices have declined from their 2022 levels, this represents a modest decline, showing that prices will remain reasonable high until 2023, when they will reach over $80 a barrel.

Furthermore, the recovery of demand, especially from Europe and Asia, was expected to lead to an increase in foreign direct investment, leading to an improvement in productivity in existing facilities and the opening of new sites as a result of high prices and high revenues.

Saudi Arabia intends to increase its oil production capacity from 12.2 million barrels per day to 13.2 million barrels per day by 2027, while the UAE intends to increase its oil production capacity from 4.2 million barrels per day to 5 million barrels per day by 2027.

However, the unit noted that Iran, which has huge oil reserves and the largest natural gas reserves in the region, will have difficulty attracting foreign direct investments in the short and medium term to develop its ability to export crude oil, refined oil, natural gas, and liquefied natural gas due to the international sanctions imposed on it.

According to the unit, Qatar has established itself as one of the largest exporters of liquefied natural gas, and as a result of foreign direct investment, has begun expanding its LNG production and export capacities to serve Asia and Europe better.

However, The Economist Intelligence reported that oil and gas sales generated huge financial revenues for Gulf states and other energy-exporting countries. The government expects this situation to continue for the foreseeable future, as money will continue to be pumped into national development projects that will attract foreign investors and global partners. There will continue to be historical obstacles in the way of foreign direct investments in some countries in the region and they will crystallize by 2023 in some cases.

Get The Latest and important news on our Telegram Channel click here to join