Latest News

- Expats Alert: PACI Just Changed The Rules For Updating Your Addr...

- Best Pizza In Kuwait: Top Brands And What To Order

- Best Budget-Friendly Chalets & Villas In Kuwait For Weekend Geta...

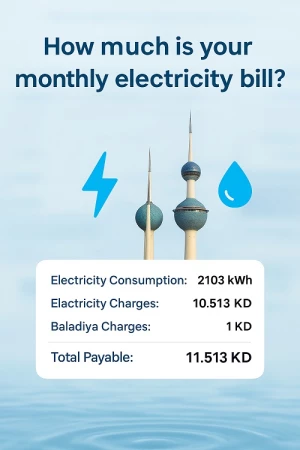

- Why Electricity Bills Are Rising In Kuwait & Smart Ways Expats C...

- App Store Optimization: Why It’s Becoming A Core Part Of SEO Str...

- Best Shower Filters In Kuwait For Hair Fall And Skin Protection

- Exness Sets A New Standard Of Consistency In The Trading Industr...

- Instant Withdrawals In Trading – A Game Changer For Traders In K...

- Best Abaya Shop In Kuwait: Editorial Review Of Abay.com

- IPhone 17 In Kuwait: Prices, Colors, Specs & Where To Buy

- Best Drinking Water Filter For Home In Kuwait

- Avoid Common Qatar E-visa Application Mistakes. Learn The Top 5...

Cbk Increases Discount Rate To 2.00 Percent

The Kuwaiti Central Bank (CBK) stated on Wednesday that the discount rate would be raised from 1.75 percent to 2.00 percent on May 5.

According to a CBK press release, the CBK Board of Directors decided to raise the discount rate from 0.25 percent to 2.00 percent effective May 5, 2022, as part of the Bank's vigilant monitoring of domestic and international economic and geopolitical developments, as well as monetary policy trends in global economies.

Furthermore, the CBK chose to change the rates of monetary policy instruments across the whole interest rate yield curve, including repo, CBK bonds and tawarruq, term deposits, direct intervention instruments, and public debt instruments, by varying percentages.

Governor Basil Al-Haroun stated in this regard that by raising the discount rate, the CBK aims to maintain an environment conducive to sustainable economic growth while taking inflation rates into account, as well as affirm the attractiveness of the Kuwaiti Dinar as a lucrative and reliable store of domestic savings, which is a mainstay of monetary policy.

The Governor went on to say that the Central Bank of Kuwait's decisions, whether they're about changing the discount rate (raising or cutting it) or regulating liquidity in the banking sector through various instruments to maintain monetary and financial stability, are based on thorough analyses of the most recent local and global economic data.

Economic performance metrics such as economic growth and inflation rates, local liquidity levels, deposits and interest rates for the Kuwaiti Dinar and major foreign currencies, as well as projected trends that may have an influence on the national economy, are included in this report.

The CBK uses modern analytical and forecasting models to estimate the current and future economic situation, capable of encompassing numerous economic variables and their complexity and interdependencies, in order to maintain a sound monetary policy. -KUNA