Latest News

- New Direct Tax Transfer Mechanism For Vehicle Imports

- Citizen Arrested For Illicit Marijuana Farming In Salwa Apartmen...

- MoE Prioritizes Local Hiring To Address Teacher Shortage

- Court Sentences Bank Employee To 5 Years For Embezzling 100,000...

- Fake ‘Sheikh’ Sentenced To 2-yr As Court Overturns Verdict

- Justice Ministry New Service On The Sahel App

- Ministry Probes 68 Cases Of Illegal Charity, Funds Collection

- Globally, Kuwait Is Among The Top Consumers Of Incense And Oud O...

- Decrease Seen In Foreign Investment

- Kuwait Customs Seized 2 Containers Laden With Tobacco At Shuwaik...

- Unpaid Salaries, Accountant Beaten Up By Workers

- The Sahel App Was Not Hacked, A Spokesman Claims

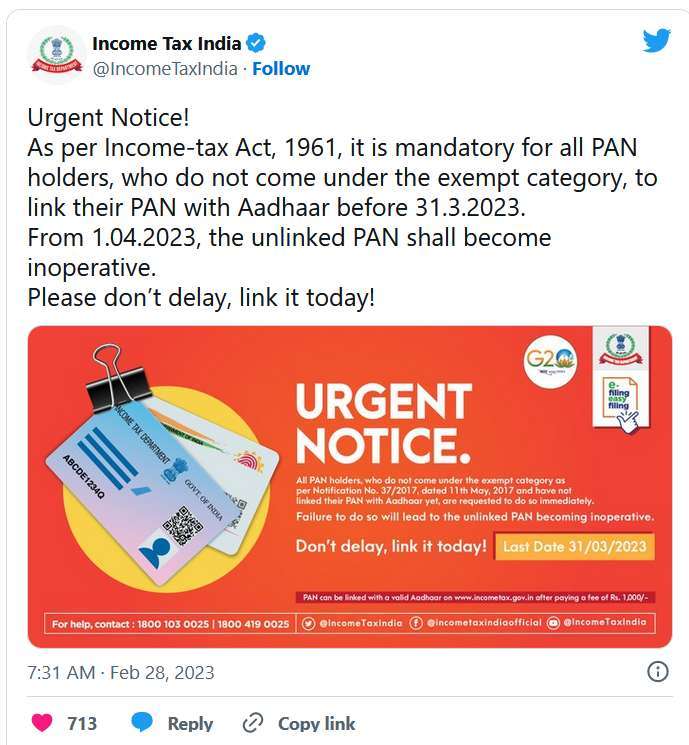

Hello Indians , Did You Link Your Pan To Aadhar Card ? March 31st Is Deadline

India’s Income Tax (IT) department has been issuing advisories to citizens on the need to link their PAN (Permanent Account Number) card with the Aadhar card, before the upcoming deadline of March 31, 2023. Failing to link the two cards will mean that a person’s PAN card will become inoperative. But does this deadline apply to non-resident Indians (NRIs), too?

Here is all you need to know.

WHAT IS A PAN CARD?

A PAN card or Permanent Account Number card is a card which contains a unique 10-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax (IT) Department in India, to any person who applies for it or to whom the department allots the number without an application.

PAN enables the department to link all transactions of the person with the department.

WHAT IS AN AADHAAR CARD?

Aadhaar is a 12-digit individual identification number issued by the Unique Identification Authority of India (UIDA) on behalf of the Government of India. The number serves as a proof of identity and address, anywhere in India.

NRIs are not mandatorily required to have an Aadhaar card. So, the deadline to link PAN card with Aadhaar would apply to you depending on whether you have an Aadhaar card.

I have an Aadhaar card

Even though NRIs are not mandatorily required to have an Aadhaar card, if you do have the card, you should link it with your PAN card before the deadline.

“If they have an Aadhaar card, they will need to link the PAN card with it before March 31, or their PAN card will become inoperative,” Jain said.

“If that happens, they will not be able to file their income tax returns going forward and even pending income tax returns will not be processed, because the PAN is linked to the previous returns. The PAN card is also linked with your Indian bank account, and if you are investing in the stock market or making any other financial investment, your PAN card will not work, so you will not be able to complete any financial transactions. Also, your KYC (Know Your Customer) records will expire, and you will not be able to update them without an active PAN card. These are all the practical aspects that you need to keep in mind when it comes to linking the two cards,” he added.

How to link your PAN with Aadhaar:

These are the steps you need to follow to link the two cards:

1. Visit www.incometax.gov.iec/foportal

2. Under the ‘quick links’ section, click on ‘Link Aadhaar’ option.

3. Next, enter Aadhaar number and PAN, and pay late fee of INR1,000 (Dh44.64) through ‘E-pay Tax functionality’ after following the instructions on screen.

4. Once payment is complete, visit ‘Link Aadhaar’ section again and enter your name, mobile number, Aadhaar number and PAN.

5. Verify the information by selecting ‘I agree to validate my Aadhaar details’ option and click on ‘Link Aadhaar’ option.

6. Enter the OTP received on your mobile number and click on ‘Validate’ to complete the linking process.

Late fee

The deadline to link PAN card with Aadhaar card has been extended a few times in the past. Earlier, the late fee was INR500 (Dh22.32), which was then increased to INR1,000 (Dh44.64).

Consequences of not linking your PAN with Aadhaar

- Your PAN will become inoperative.

- Filing ITRs will not be possible.

- Pending returns will not be processed.

- Pending refunds cannot be issued.

- Pending proceedings as in the case of defective return, cannot be completed.

- Tax will be deducted at a higher rate.

I do not have an Aadhaar card

If you do not have an Aadhaar card, you can simply update your PAN card details through the online system, according to Jain, and do not need to worry about the deadline to link PAN card with Aadhar.

“When you visit the Income Tax Department’s online portal – eportal.incometax.gov.in – you will simply need to access your profile and select your status as a non-resident. Once you do that, the government will know that you are falling under the exempt category,” Jain said.

Trending News

-

Eid Al Fitr 2024: Crescent Moon Not Sighted In Sau...

08 April 2024

Eid Al Fitr 2024: Crescent Moon Not Sighted In Sau...

08 April 2024 -

Kuwait Implements Home Biometrics Services Ahead O...

14 April 2024

Kuwait Implements Home Biometrics Services Ahead O...

14 April 2024 -

When Will Eid Al Fitr 2024 Take Place In Qatar, Ba...

08 April 2024

When Will Eid Al Fitr 2024 Take Place In Qatar, Ba...

08 April 2024 -

On Sunday, The Meteorological Department Warns Of...

07 April 2024

On Sunday, The Meteorological Department Warns Of...

07 April 2024 -

Kuwait Airways Provides Update On Flight Schedule...

14 April 2024

Kuwait Airways Provides Update On Flight Schedule...

14 April 2024 -

Kuwait Airways Introduces Convenient Home Luggage...

15 April 2024

Kuwait Airways Introduces Convenient Home Luggage...

15 April 2024 -

Gathering For Eid Al-Fitr Prayers: Kuwaiti Citizen...

10 April 2024

Gathering For Eid Al-Fitr Prayers: Kuwaiti Citizen...

10 April 2024 -

Winners Of Kuwait National Assembly 2024 Elections

06 April 2024

Winners Of Kuwait National Assembly 2024 Elections

06 April 2024 -

An Egyptian Expat Dies At Kuwait's Airport

11 April 2024

An Egyptian Expat Dies At Kuwait's Airport

11 April 2024 -

Bay Zero Water Park Kuwait: Summer Season Opens Ei...

11 April 2024

Bay Zero Water Park Kuwait: Summer Season Opens Ei...

11 April 2024

Comments Post Comment