Latest News

- Court Sentences Bank Employee To 5 Years For Embezzling 100,000...

- Fake ‘Sheikh’ Sentenced To 2-yr As Court Overturns Verdict

- Justice Ministry New Service On The Sahel App

- Ministry Probes 68 Cases Of Illegal Charity, Funds Collection

- Globally, Kuwait Is Among The Top Consumers Of Incense And Oud O...

- Decrease Seen In Foreign Investment

- Kuwait Customs Seized 2 Containers Laden With Tobacco At Shuwaik...

- Unpaid Salaries, Accountant Beaten Up By Workers

- The Sahel App Was Not Hacked, A Spokesman Claims

- Four Expats Arrested For Stealing Copper Cables Worth 60,000 Din...

- Indian National Died In Abdalli Car Accident

- Work Permits And Foreign Worker Transfers Are Amended By PAM

Boursa Kuwait Ended Last Week In The Red Zone

Boursa Kuwait ended last week in the red zone. The Premier Market Index closed at 5,257.16 points, down by 1.09%, the Main Market Index declined by 0.49% after closing at 4,718.42 points, and the All-Share Index closed at 5,065.81 points down by 0.89%.

Furthermore, last week’s average daily turnover decreased by 5.66%, compared to the preceding week, reaching around KD 11.10 million, whereas trading volume average reached around 66.73 million shares, recording a drop of 11.98%.

The Boursa lost around KD 255 million, as the market capitalization for the total listed stocks dropped by the end of last week to reach about KD 28.35 billion against KD 28.60 billion in a week earlier, down by 0.89%. The Boursa gains since the application of the new market segmentation contracted to reach around KD 490.50 million or 1.76%. (Note: The market capitalization for the listed companies in the Boursa is calculated based on the weighted average number of outstanding shares as per the latest available official financial statements).

In addition, the weak performance witnessed by the Boursa during the last week was caused by some investors’ refrain from trading, especially in light of the waiting state for the listed companies results for the third quarter period of the current year, in addition to the active profit collection operations that the Boursa is witnessing for the past couple of weeks. Also, this performance came in parallel with the drop of the trading indicators, whereas the total number of traded stocks decreased by 11.98% reaching 333.67 million stock, while the total trading value declined by 5.66% to reach KD 59.99 million.

Moreover, the selling pressures witnessed by the Boursa concentrated on many listed stocks in the market, headed by the stocks listed in the Premier Market, which was reflected on the Premier Market Index, the most declining index among the three market indices, as it recorded a loss of 1.09% by the end of last week. Last week witnessed trading over 147 stock out of 175 listed stock in the market, where prices of 43 stock increased against prices of 88 stock decreased, and prices of 44 stock remained at no change.

Sectors’ Indices

Eight of Boursa Kuwait’s sectors ended last week in the red zone, while two recorded increases, and the Health Care & Technology sectors remained at no change. Last week’s highest loser was the Consumer Goods Sector, as its index declined by 2.10% to end the week’s activity at 815.54 points. The Industrial Sector was second on the losers’ list, which index declined by 1.59%, closing at 967.69 points, followed by the Real Estate sector, which index declined by 1.49%, closing at 871.47 points.

On the other hand, last week’s highest gainer was the Basic Materials Sector, achieving 4.21% growth rate as its index closed at 1,225.83 points. The Insurance Sector came in the second place, as its index closed at 962.42 points recording 0.08% increase.

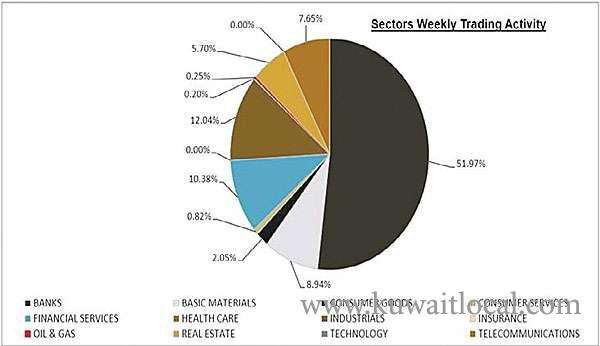

Sectors’ Activity

The Financial Services Sector dominated a total trade volume of around 101.43 million shares changing hands during last week, representing 30.40% of the total market trading volume. The Banks Sector was second in terms of trading volume as the sector’s traded shares were 28.15% of last week’s total trading volume, with a total of around 93.92 million shares. On the other hand, the Banks Sector’s stocks were the highest traded in terms of value; with a turnover of around KD 31.18 million or 51.97% of last week’s total market trading value. The Industrial Sector took the second place as the sector’s last week turnover was approx KD 7.22 million representing 12.04% of the total market trading value

SOURCE : ARABTIMES

Trending News

-

Eid Al Fitr 2024: Crescent Moon Not Sighted In Sau...

08 April 2024

Eid Al Fitr 2024: Crescent Moon Not Sighted In Sau...

08 April 2024 -

Kuwait Implements Home Biometrics Services Ahead O...

14 April 2024

Kuwait Implements Home Biometrics Services Ahead O...

14 April 2024 -

When Will Eid Al Fitr 2024 Take Place In Qatar, Ba...

08 April 2024

When Will Eid Al Fitr 2024 Take Place In Qatar, Ba...

08 April 2024 -

On Sunday, The Meteorological Department Warns Of...

07 April 2024

On Sunday, The Meteorological Department Warns Of...

07 April 2024 -

Kuwait Airways Provides Update On Flight Schedule...

14 April 2024

Kuwait Airways Provides Update On Flight Schedule...

14 April 2024 -

Kuwait Airways Introduces Convenient Home Luggage...

15 April 2024

Kuwait Airways Introduces Convenient Home Luggage...

15 April 2024 -

Gathering For Eid Al-Fitr Prayers: Kuwaiti Citizen...

10 April 2024

Gathering For Eid Al-Fitr Prayers: Kuwaiti Citizen...

10 April 2024 -

Winners Of Kuwait National Assembly 2024 Elections

06 April 2024

Winners Of Kuwait National Assembly 2024 Elections

06 April 2024 -

Bay Zero Water Park Kuwait: Summer Season Opens Ei...

11 April 2024

Bay Zero Water Park Kuwait: Summer Season Opens Ei...

11 April 2024 -

An Egyptian Expat Dies At Kuwait's Airport

11 April 2024

An Egyptian Expat Dies At Kuwait's Airport

11 April 2024

Comments Post Comment